BUT IT MUST AVOID A DEFECT OF TOO MANY OTHER INDUSTRIES

(Feat. A Formula to Calculate the P&L of a Legal Cannabis Dispensary or Store)

By Darryl K. Henderson, J.D., January 14, 2019

THE PURPOSE OF BUSINESS

The purpose of business is to create value for customers, employees, business partners, investors and communities. Value is certainly being created within the U.S. legal cannabis industry:

- The combination of hemp-derived CBD products and legal cannabis sales are projected to reach $45B by 2022.

- It is a source of bona fide therapeutic relief and life-enjoyment for Customers.

- It is a source of gainful employment for Employees.

- It is a source of viable money-making opportunities for Business Partners.

- It is a source of wealth creation for Investors.

- It is a source of crime reduction and revenue for economic and social services development for Communities.

There is still time to avoid the defect of too many other industries, however:

- The failure, too often, to leverage the value of diversity with equity and inclusion

How can that defect be avoided?

- In a nutshell, minimize the natural tendencies and negative effects of ego, greed, power, isms and xenophobia. More details are provided below.

At the outset, let’s be real, the U.S. illegal “black” market of cannabis is not dead. That market is estimated to be 4 to 6-times the size of the current legal cannabis industry – around $60B – and which is still 36% larger than sales projections for the combination of hemp-derived CBD products and legal cannabis sales. What are the drivers? For black market producers and sellers, (i) expensive or inaccessible state and local legal cannabis business licensing, (ii) strict and sometimes cumbersome legal cannabis lab testing requirements, (iii) the IRC Section 280E federal income tax requirement, (iv) exorbitant state and local legal cannabis taxes make operating in the black market easier, quicker and less expensive, and (v) consumer demand is strong. This translates to ginormous opportunities for the legal cannabis industry once all the factors to positively influence legal cannabis consumer demand are properly addressed.

Cannabis is illegal at the federal level under the U.S. Controlled Substances Act of 1970 (the “CSA”). The CSA classifies cannabis as a Schedule I substance, placing it alongside heroin, LSD and ecstasy in a category reserved for drugs considered to have no medicinal value, have a high potential for abuse, and are unsafe to use without medical supervision. Cocaine, crystal meth and fentanyl are all listed in Schedule II of the CSA, which is reserved for less dangerous drugs. There are five schedules in total. Schedule V includes codeine, Epidiolex and Lyrica.

By contrast, “industrial hemp,” which is a form of cannabis, was legalized in 2018 under the 2018 Farm Bill, signed into law by President Trump on December 20th. Industrial hemp is now legal in all U.S. territories. It has been removed from coverage under the CSA and is considered an agricultural commodity, like wheat, corn and tobacco. Hemp businesses will no longer face the business and regulatory obstacles associated with handling a Schedule I illegal substance under the CSA – like banking barriers, business insurance barriers, the IRC Section 280E requirements, being barred from advertising on Facebook and Instagram, etc.

Industrial hemp has less than 0.3% THC – which is the psychoactive chemical compound in cannabis that causes a person to get “high.” It does, however, have a high concentration of CBD – which is the non-psychoactive chemical compound that does not get a person high and is linked to several health benefits. Industrial hemp is used to make CBD-oil based health products, food products, rope, clothing, paper, building supplies, fuel, etc.

The FDA retains regulatory authority over foods, drugs, dietary supplements and cosmetics. So the recent FDA Statement regarding hemp legalization requires businesses that sell hemp-derived products in interstate commerce – as is already occurring – to avoid stating that those products will yield therapeutic, dietary, nutritional or cosmetic benefits without prior FDA approval. An exception to this FDA parameter is GRAS products (i.e., hemp seeds).

I am personally intrigued with the medicinal value of cannabis. To think that we can provide therapeutic relief to patients and their families for traumatic brain injury, cancer, sickle cell, Parkinson’s disease, chronic pain, epilepsy in children, PTSD, psoriasis, etc. simply through the use of Cannabis indica and Cannabis sativa plants (including non-hemp and hemp cannabis) – those are “life-quality” enhancements worth supporting.

For example, in desperation, one of my relatives decided to try a CBD-oil salve for his chronic swelling and painful knees. The warning on his doctor prescribed Pharma cream indicates that overuse could cause heart problems. So he stopped using the Pharma cream and tried to endure the knee swelling and pain. But the CBD-oil salve has no troubling warnings and after applying it to his knees he felt relief within 2 minutes. No more swelling. No more pain. And that has remained constant over six weeks and counting. This gentleman is a church deacon, marine veteran, and the model of an upstanding citizen. A CBD product, derived from industrial hemp, has changed his life.

The enjoyment, rest and relaxation that can also be derived from responsibly using legal cannabis as an adult-use product – similar to consuming wine, beer or liquor – is merely added value.

As of today, the legalization of cannabis in U.S. territories – including Washington, D.C., Guam and Puerto Rico – for medical use (MMJ), recreational or adult-use (RMJ), CBD-oil, and industrial hemp is as follows:

- MMJ = 36 territories (29 active)

- RMJ = 11 territories (7 active)

- CBD-oil only = 14 territories (14 active)

- Industrial hemp = 53 territories under the 2018 Farm Bill (42 state-pilot programs)

- Idaho and South Dakota have not legalized cannabis in any way, so outside of the federal legalization of industrial hemp, cannabis is illegal in those two states.

In 2017 legal cannabis sales in the U.S. totaled $8.3B. Sales are projected to reach $10B in 2018. There are over 121,000 people employed in the legal cannabis industry today. Analysts predict that the industry will grow to $23B in sales by 2021, with over 290,000 employees.

A couple of years ago, one acre of industrial hemp sold for $30,000. In 2018, one acre of industrial hemp sold for up to $50,000. Analysts predict that in 2019 one acre of industrial hemp will likely sell for up to $100,000. One acre of hemp yields 1,200 to 1,500 plants, and each plant yields about 1 pound of product. Hemp-derived CBD products will have sales of $570m in 2018 and are predicted to reach $22B by 2020. Currently, retailers that sell hemp-derived CBD products include Estee Lauder, GNC, Whole Foods, Wal-Mart, and Home Depot.

How much money do cannabis retailers make – i.e., medical dispensaries or adult-use and CBD product stores? The answer varies. But here is a formula and some conservative P&L estimates:

Hours of Operation =

Mon-Sat = 10 am – 8 pm; Sun = 11 am – 7 pm = 69 hours per week

Transactions =

15 per hour; 150 per day; 1,050 per week; 4,200 per month; 50,400 per year; $80 per transaction

Revenue (including state/local sales and excise tax) =

100% = $4,032,000

COGS =

42% = $1,693,440

Gross Profit =

58% = $2,338,560

Federal Income Tax =

Corporate Rate of 21% (and per IRC Section 280E) = $491,097.60

Operating Expenses =

40% = $1,612,800

Operating Profit =

6% = $234,662.40

ITDA =

5% = $201,600

Net Income =

1% = $33,062.40

The calculations above are impacted by several variables, including geographic location; state and local tax, license and other fees; size and foot traffic of a dispensary or store; and whether the retailer sells medical or adult-use, flower or non-flower, CBD products, and apparel and other ancillary products. Some dispensaries report annual revenue of more than $20m.

New Frontier Data, a research firm that analyzes the legal cannabis industry, estimated that in 2017 states collected $655m in tax revenue on the $8.3B legal cannabis sales (i.e., sales tax, excise tax, cultivation tax and product tax), of which $559m came solely from cannabis, not vaporizers, grinders and other ancillary products.

New Frontier Data projects that if cannabis were federally legalized in all 50 states the U.S. government would collect at least $132B in tax revenue over the next eight years. And federal legalization would create 782,000 jobs immediately, growing to 1.1 million by 2025, including jobs with cultivation, production, retail and ancillary businesses.

Major corporations are closely watching the value being created within the legal cannabis industry. And some of those major players have jumped into the water:

- Constellation Brands, the maker of Corona beer, invested $2.4B in a cannabis firm.

- Heineken, the beer maker, recently acquired a firm that is producing a new IPA beer made with cannabis. Another Heineken subsidiary has made a THC-infused sparkling water.

- Molson Coors Brewing has formed a joint venture with a cannabis firm.

- Coca-Cola has announced that it is having conversations with a cannabis firm about making cannabis-infused beverages.

- Anheuser-Busch InBev is partnering with Tilray to spend $100m to research cannabis-infused beverages, infused with THC and CBD, and the research is said to “guide future decisions about potential commercial opportunities.”

- Altria Group, the owner of Marlboro brand cigarettes and an investor in Anheuser-Busch InBev, has invested $1.8B in a cannabis firm. (Altria is also buying a 35% share of the vaping company JUUL for nearly $13B.)

- Scotts Miracle-Gro, the lawn and garden company, has invested over $140m in cannabis firms involved in plant nutrient and hydroponic technology.

In 2003, U.S. Patent No. 6,603,507 was granted to the U.S. Department of Health and Human Services. That patent covers the potential use of non-psychoactive cannabinoids — the chemical compounds in cannabis that do not cause a person to get “high,” – to protect the brain from damage or degeneration caused by certain diseases, like cirrhosis. Yes, that is contrary to the assertion under the 1970 CSA that cannabis has no medicinal value.

Jerome Adams, the U.S. Surgeon General, recently made the following statement during an event at Harvard University on drug addiction, as reported by the State House Wire Service: “Just as we need to look at criminal justice laws, rules and regulations, we need to look at health laws, rules and regulations, and that includes the scheduling system. I’ll take it somewhere else: marijuana. We need to look at the way we schedule different medications across the board, because one of the concerns that I have with marijuana is the difficulty that the folks have to do research on it, because of the scheduling system.”

According to the National Institutes of Health (NIH), “THC can increase appetite and reduce nausea” and “may also decrease pain, inflammation (swelling and redness), and muscle control problems.” NIH also recognizes CBD as a chemical compound with potential medical use in “reducing pain and inflammation, controlling epileptic seizures, and possibly even treating mental illness and addictions.” Again, yes, that is contrary to the assertion under the 1970 CSA that cannabis has no medicinal value.

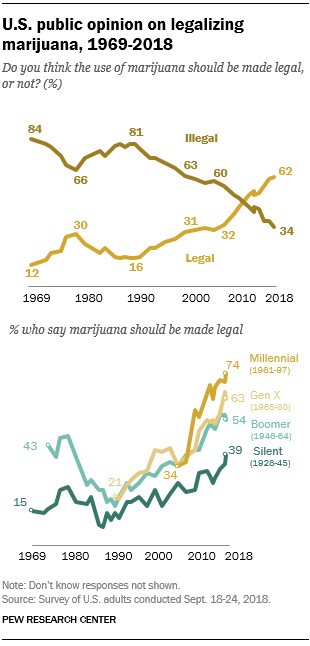

So where are we? Let the evolution of the U.S. legal cannabis industry continue – guided by medical research, public education, product quality and safety, protection of community standards, environmental protection, legal compliance, and equitable and inclusive opportunities for diverse segments of communities to contribute to and enjoy the economic value of the industry. According to the Pew Research Center and Gallup, the majority of U.S. adults feel the same way: 62% of U.S. adults (Pew) and 66% of Americans (Gallup) support regulated cannabis legalization, according to surveys conducted in October 2018.

KEY MILESTONES IN THE LEGALIZATION JOURNEY OF CANNABIS IN THE U.S.

Pre-1930s:

- It was a source of textile products, medicines and food products, as well as rest, relaxation and enjoyment for a few hundred years prior to the 1930s (i.e., both hemp and non-hemp cannabis)

1930s:

- It became demonized as an illicit drug in the 1930s without any medical, scientific, criminology or social data and analysis; the only basis was racist and xenophobic views about Mexican and Filipino immigrants and African American jazz musicians and artists. Harry Anslinger was the single most influential public figure to create the negative stigma surrounding cannabis. He testified before Congress and said the following: “Marijuana is the most violence-causing drug in the history of mankind… There are 100,000 total marijuana smokers in the US, and most are Negroes, Hispanics, Filipinos and entertainers. Their Satanic music, jazz and swing result from marijuana use. This marijuana causes white women to seek sexual relations with Negroes, entertainers and any others.” Anslinger also led the institutionalization of the derogatory slang term “marijuana,” instead of the proper term “cannabis,” referring to the Cannabis sativa and Cannabis indica plants.

1930s to 1970s:

- During the late 1930s through the 1970s, anti-cannabis legislation was put in place both domestically and internationally. Remember that the CSA was signed in 1970. Also, the Single Convention on Narcotic Drugs, as amended (the “Single Convention”), is an international treaty that was signed in 1961. It has 186 nation parties, including the U.S., as of February 2018. The Single Convention is designed by international cooperation to (1) to combat narcotic drug abuse by limiting the cultivation, manufacture, production, distribution, import, export, trade, possession and use of specific drugs, defined to be narcotics, and (2) to deter and discourage drug trafficking of specific narcotic drugs. Cannabis is listed as a Schedule I and Schedule IV drug under the Single Convention. The one exception to the treaty would be if such drugs were used for medical treatment and scientific research.

1996:

- It was legalized by the state of California in 1996 for medical use (now medical cannabis is legal in 36 U.S. territories, of which 29 are active).

2003:

- In 2003, U.S. Patent No. 6,603,507 was granted to the U.S. Department of Health and Human Services, covering the potential use of non-psychoactive cannabinoids to protect the brain from damage or degeneration caused by certain diseases.

2012:

- In 2012, it was legalized by the states of Colorado and Washington for adult-use or recreational use (now adult-use cannabis is legal in 11 U.S. territories, of which 7 are active).

2013:

- In 2013, it was the subject of a CNN documentary entitled, “Weed 1: A Special Report by Dr. Sanjay Gupta.”

2018:

- In 2018, the FDA-approved the CBD-based drug Epidiolex to accompany three other cannabis-based drugs – i.e., Marinol, Syndros and Cesamet, and the DEA accepted those drugs and classified them as Schedule V substances under the CSA. (Epidiolex is derived from non-hemp cannabis with less than 0.1% THC.)

- Also, in 2018 hemp became legalized as an agricultural commodity by the Farm Bill of 2018 and was completely removed from coverage under the CSA (i.e., the hemp cannabis plants with less than 0.3% THC), and hemp-derived CBD products are being purchased both online and over-the-counter nationally, no matter whether the products have been approved by the FDA.

2019:

- Today it is the fuel of a U.S. industry with most recent annual sales of $10B, and projected growth to $23B and 290,000 employees by 2022 – and the combination of hemp-derived CBD products and legal cannabis sales are projected to grow to $45B with over 300,000 employees by 2022.

BUT PEOPLE OF COLOR ARE TOO OFTEN EXCLUDED FROM THE VALUE DERIVED FROM OWNING, OPERATING AND WORKING WITHIN THE U.S. LEGAL CANNABIS INDUSTRY

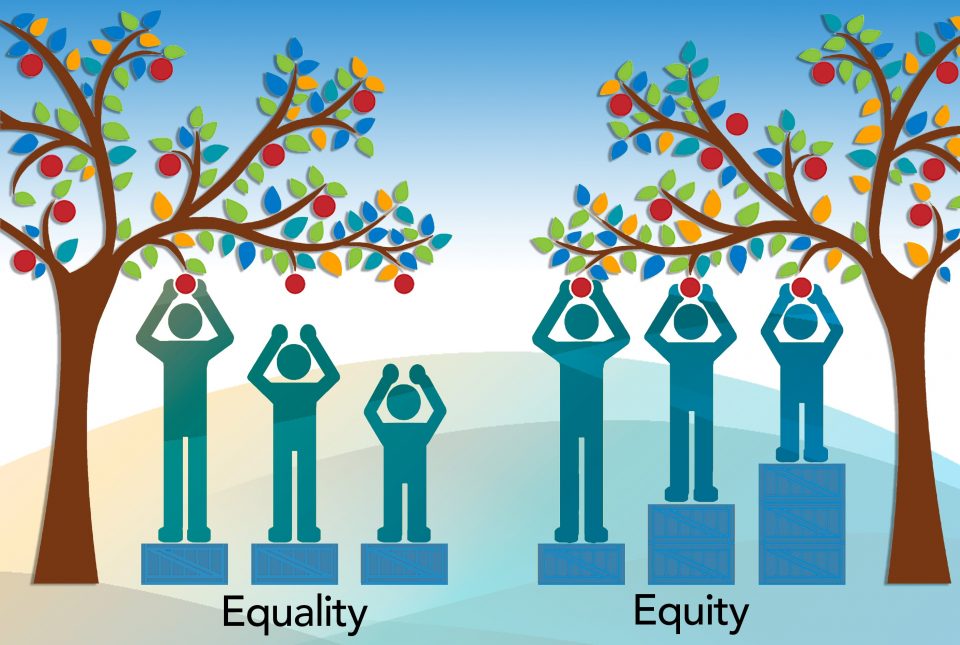

Every human being has a God-given equal (“same”) right to be treated equitably (“fairly”) so as to leverage his or her unique abilities and skills.

More so than beer, wine and liquor, for years, cannabis has been a unifying “social element” for people of different personalities, characteristics, backgrounds and affiliations.

For example, at colleges and universities across the nation you can find the equivalent of a white dude from Orange County, CA + a white babe from West Virginia + an Asian dude from New York + an African American dude from the Lower Ninth Ward in New Orleans + an African American babe from Atlanta + and a Hawaiian babe from Honolulu socializing and passing cannabis joints, vaporizers, bongs, infused beverages, etc. The U.S. legal cannabis industry should reflect that degree of diversity and inclusion at every level and in every aspect.

Unfortunately, the U.S. legal cannabis industry struggles with diversity and inclusion, particularly the inclusion of people of color (PoC).

Marijuana Business Daily, a leading cannabis industry publication, has reported that white men own and operate 81% of U.S. legal cannabis businesses, while PoC own and operate just 19% of those businesses. By comparison, white men own 57% of total privately-held businesses in the U.S. and make-up 40% of the U.S. labor force.

The primary challenges to involving PoC in the legal cannabis industry are as follows:

- Fear = the fear amongst PoC to get involved in the industry, driven by their awareness of the disproportionate number of convictions for PoC for drug crimes (e.g., 57% of people in state prisons for drug offenses are black and Latinx, but they only make-up 32% of the U.S. population), and the lack of education about both the benefits of cannabis use and the status of cannabis legalization.

- Money = the huge disproportionate lack of capital and access to capital for PoC to afford the thousands-to-millions of dollars in application fees, license fees, permits and capital outlays needed to launch and operate a legal cannabis business.

- Exclusion = the failure, too often, to include qualified PoC in the different ownership, governance, leadership and staff opportunities within the industry, as well as the inability of too many PoC to participate in the industry because of criminal drug convictions.

The solutions to the exclusion of PoC in the legal cannabis industry may include the following:

- Federal Legalization = remove cannabis from Schedule I of the CSA.

- Scientific Support = build more medical research and documentation of the benefits and risks of cannabis use.

- Education = establish community education initiatives about the benefits and risks of responsibly using cannabis, the existence of community services for any form of substance addiction, and the status of cannabis legalization – i.e., education to offset the 80-plus years of negative stigma pinned upon the cannabis plant.

- Inclusion = implement well-executed state-regulated legal cannabis social equity programs, as well as comprehensive diversity and inclusion initiatives within legal cannabis businesses and trade associations. And create tax credits, favorable loans and grants for DBE-owned legal cannabis start-ups.

Inclusion is the unfinished business of diversity. That fact has too often been a defect of several U.S. industries. But the U.S. legal cannabis industry is new-enough to avoid widespread infection by that defect if the right preventative steps are taken immediately.

PROGRAM MANAGEMENT PARTNERSHIPS CAN BE SOLUTIONS TO THE ISSUES WITH STATE-REGULATED LEGAL CANNABIS SOCIAL EQUITY PROGRAMS

In an effort to correct the ill-effects of the war on drugs on PoC and the poor, a few states, like California, are taking deliberate steps to involve more PoC and economically disadvantaged individuals in the legal cannabis industry through social equity programs. California has allocated $10m towards its social equity programs, and in some instances local municipalities are supplementing those funds.

However, many legal cannabis industry insiders believe these programs create or fail to address more issues than create remedies to the exclusion of PoC. The issues cited include:

- State and local staffing and funding shortfalls within agencies charged to operate social equity programs.

- Complex cannabis business license application processes, driven by heavily matted regulations, which benefit applicants with more capital and experience. Large companies can use teams of attorneys and business proposal-writing specialists to complete cannabis business license applications and wade through layers of state and local government bureaucracy. PoC too often do not have the luxury of those resources.

- The exorbitant costs – cannabis business license “application fees” range from $250 to $25,000 and cannabis business “licenses” range from $1,000 to $200,000 annually, depending upon the state and whether the fee is for cultivation, production, lab testing, distribution, or retail businesses.

- Long waits to acquire cannabis business licensing for those applicants who do qualify for the social equity programs.

- Limited oversight of business partnership arrangements between social equity applicants and outside investors, which has led, in too many instances, to the outside investors hijacking the ownership and operations of the social equity applicants’ businesses through tricky partnership agreement terms and conditions.

As reported by Marijuana Business Daily, “Many social equity applicants typically lack access to bank loans or venture capital and/or have no knowledge of how to apply for those resources to get their cannabis companies off the ground. So, partnerships between applicants and investors are often necessary. While partnerships are intended to financially benefit both parties, critics contend the practice can give rise to opportunities for investors to divest social equity applicants of their share in the business.”

On the other hand, some states just do it and do it right. One example is Louisiana. The first of ten dispensary license awarded in the state of Louisiana went to a half-century-old African American-owned and operated pharmacy named H&W Drug Store. And one of the two cannabis cultivation and processing operations is Southern University, a historically black university. That level of diversity, equity and inclusion must exist at every level and in every aspect of the Louisiana legal medical cannabis program – across a variety of diversity dimensions.

Nevertheless, states should establish “program management partnerships” with community organizations to provide business expert oversight and supportive services to social equity applicants. The National Urban League (NUL) and business management consulting firms – just two examples – can provide social equity program participants with necessary oversight and business support.

The expert oversight and supportive services can include advisory, program management and staff augmentation services delivery in the areas of business partnerships, contracting, organization development, HR, accounting, finance, IT, marketing, operations management, legal compliance, etc. Those oversight and supportive services can be paid for with the state and local revenue from legal cannabis taxes and licensing fees collected from cultivation, production, lab testing, distribution, and retail operators.

But the federal government holds the real key to addressing issues with legal cannabis social equity programs. Removing cannabis from the CSA would provide a clearer and more comfortable path for states to attract and engage outside business experts to help with social equity programs – especially to engage 501(c) (3) organizations like NUL.

The Leadership Conference on Civil and Human Rights recently sent a letter to the 116th Congress that included the following recommendation: “Pass legislation de-scheduling marijuana with racial equity and justice reform components.” The letter stresses that bills to federally legalize cannabis should “include reparative justice/reinvestment language for communities most impacted” by directing legal cannabis tax revenue towards those communities. The letter further states: “End federal prohibition in a way that acknowledges decades of harm faced by communities of color and low-income communities.”

On December 18th, congressional democrats on the Joint Economic Committee published a report championing the “economic benefits of legalized cannabis at the state and national levels.” Named, “The National Cannabis Economy,” the report finds that the marijuana industry brought in more than $8 billion in sales in 2017, with sales estimated to reach $10 billion this year and expected to soar to $22 billion by 2022. “The growth of the cannabis economy presents opportunities for greater job creation, more tax revenue, and better patient care,” the report states, while also summarizing the banking and tax issues that current federal policy causes for state-regulated cannabis businesses. “It’s time we legalize marijuana, but at the minimum, we must reduce the conflicts between federal and state laws so that the industry can continue to create jobs and bolster state economies,” said Senator Martin Heinrich, (D-NM), the ranking member of the committee. “This conflict hurts small businesses and constrains the economic benefits of legal cannabis. But in order to realize the benefits, we must act on legislation ….”

Three separate bills to end federal cannabis prohibition have been introduced in the 116th Congress. Seven such bills were introduced in the 115th Congress. As young athletes say today, “Let’s go!” And as we move forward, let’s make sure that we foster equity and inclusion to leverage the value of diversity at every level and in every aspect of the U.S. legal cannabis industry.

About the Author:

At his core, Darryl is motivated to help, teach and lead people (his “life mission”). He has amassed a broad range of knowledge and skills in a variety of roles, including HR executive, chief diversity officer, chief employment compliance officer, operations executive, business management consultant, executive coach, entrepreneur, and employment and commercial lawyer. Darryl earned a Juris Doctorate degree from the University of Georgia School of Law and a Bachelor of Arts in Economics degree from Emory University. His LinkedIn Profile: https://www.linkedin.com/in/darryl-k-henderson-b87521134

WOW,,,, this is a long article. Not to easy to follow.

BUT,,, if cannabis is good, if the Saints players use some, will that help them to perform better and win?

Mr.Darryl Henderson,

Could you please send me info for investment opportunities here in Louisiana.