Bitcoin, Ethereum, and other crypto are revolutionizing how we invest, bank, and use money. Read this beginner’s guide to learn more.

At its core, cryptocurrency is typically decentralized digital money designed to be used over the internet. Bitcoin, which launched in 2008, was the first cryptocurrency, and it remains by far the biggest, most influential, and best-known. In the decade since, Bitcoin and other cryptocurrencies like Ethereum have grown as digital alternatives to money issued by governments.

- The most popular cryptocurrencies, by market capitalization, are Bitcoin, Ethereum, Bitcoin Cash and Litecoin. Other well-known cryptocurrencies include Tezos, EOS, and ZCash. Some are similar to Bitcoin. Others are based on different technologies, or have new features that allow them to do more than transfer value.

- Crypto makes it possible to transfer value online without the need for a middleman like a bank or payment processor, allowing value to transfer globally, near-instantly, 24/7, for low fees.

- Cryptocurrencies are usually not issued or controlled by any government or other central authority. They’re managed by peer-to-peer networks of computers running free, open-source software. Generally, anyone who wants to participate is able to.

- If a bank or government isn’t involved, how is crypto secure? It’s secure because all transactions are vetted by a technology called a blockchain.

- A cryptocurrency blockchain is similar to a bank’s balance sheet or ledger. Each currency has its own blockchain, which is an ongoing, constantly re-verified record of every single transaction ever made using that currency.

- Unlike a bank’s ledger, a crypto blockchain is distributed across participants of the digital currency’s entire network

- No company, country, or third party is in control of it; and anyone can participate. A blockchain is a breakthrough technology only recently made possible through decades of computer science and mathematical innovations.

Most importantly, cryptocurrencies allow individuals to take complete control over their assets

Coinbase CEO Brian Armstrong’s Vision for the Future of Cryptocurrency

Key concepts

Transferability Crypto makes transactions with people on the other side of the planet as seamless as paying with cash at your local grocery store.

Privacy When paying with cryptocurrency, you don’t need to provide unnecessary personal information to the merchant. Which means your financial information is protected from being shared with third parties like banks, payment services, advertisers, and credit-rating agencies. And because no sensitive information needs to be sent over the internet, there is very little risk of your financial information being compromised, or your identity being stolen.

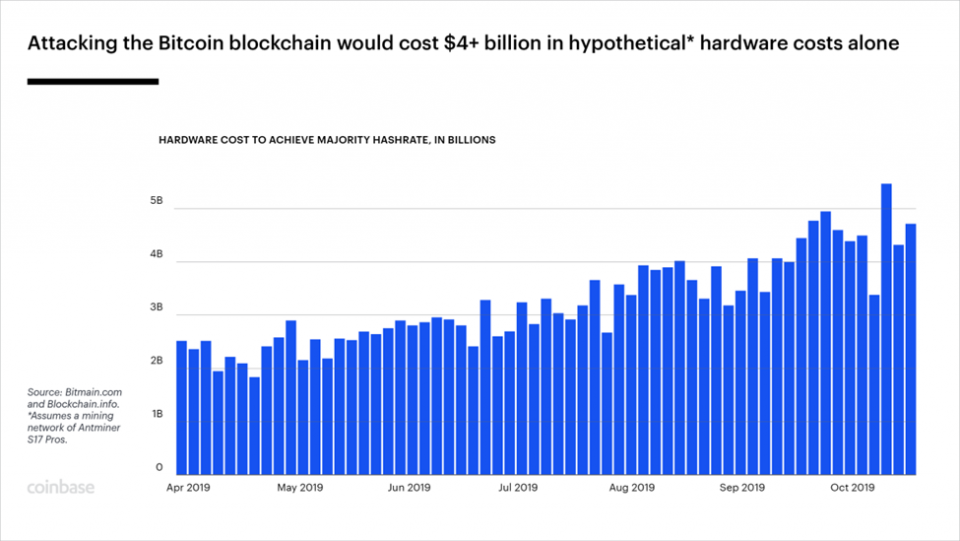

Security Almost all cryptocurrencies, including Bitcoin, Ethereum, Tezos, and Bitcoin Cash are secured using technology called a blockchain, which is constantly checked and verified by a huge amount of computing power.

Portability Because your cryptocurrency holdings aren’t tied to a financial institution or government, they are available to you no matter where you are in the world or what happens to any of the global finance system’s major intermediaries.

Transparency Every transaction on the Bitcoin, Ethereum, Tezos, and Bitcoin Cash networks is published publicly, without exception. This means there’s no room for manipulation of transactions, changing the money supply, or adjusting the rules mid-game.

Irreversibility Unlike a credit card payment, cryptocurrency payments can’t be reversed. For merchants, this hugely reduces the likelihood of being defrauded. For customers, it has the potential to make commerce cheaper by eliminating one of the major arguments credit card companies make for their high processing fees.

Safety The network powering Bitcoin has never been hacked. And the fundamental ideas behind cryptocurrencies help make them safe: the systems are permissionless and the core software is open-source, meaning countless computer scientists and cryptographers have been able to examine all aspects of the networks and their security.

Why is cryptocurrency the future of finance?

Cryptocurrencies are the first alternative to the traditional banking system, and have powerful advantages over previous payment methods and traditional classes of assets. Think of them as Money 2.0. — a new kind of cash that is native to the internet, which gives it the potential to be the fastest, easiest, cheapest, safest, and most universal way to exchange value that the world has ever seen.

- Cryptocurrencies can be used to buy goods or services or held as part of an investment strategy, but they can’t be manipulated by any central authority, simply because there isn’t one. No matter what happens to a government, your cryptocurrency will remain secure.

- Digital currencies provide equality of opportunity, regardless of where you were born or where you live. As long as you have a smartphone or another internet-connected device, you have the same crypto access as everyone else.

- Cryptocurrencies create unique opportunities for expanding people’s economic freedom around the world. Digital currencies’ essential borderlessness facilitates free trade, even in countries with tight government controls over citizens’ finances. In places where inflation is a key problem, cryptocurrencies can provide an alternative to dysfunctional fiat currencies for savings and payments.

- As part of a broader investment strategy, crypto can be approached in a wide variety of ways. One approach is to buy and hold something like bitcoin, which has gone from virtually worthless in 2008 to thousands of dollars a coin today. Another would be a more active strategy, buying and selling cryptocurrencies that experience volatility.

- One option for crypto-curious investors looking to minimize risk is USD Coin, which is pegged 1:1 to the value of the U.S. dollar. It offers the benefits of crypto, including the ability to transfer money internationally quickly and cheaply, with the stability of a traditional currency. Coinbase customers that hold USDC earn rewards, making it an appealing alternative to a traditional savings account.

Digital currencies provide equality of opportunity, regardless of where you were born or where you live.

From COINBASE