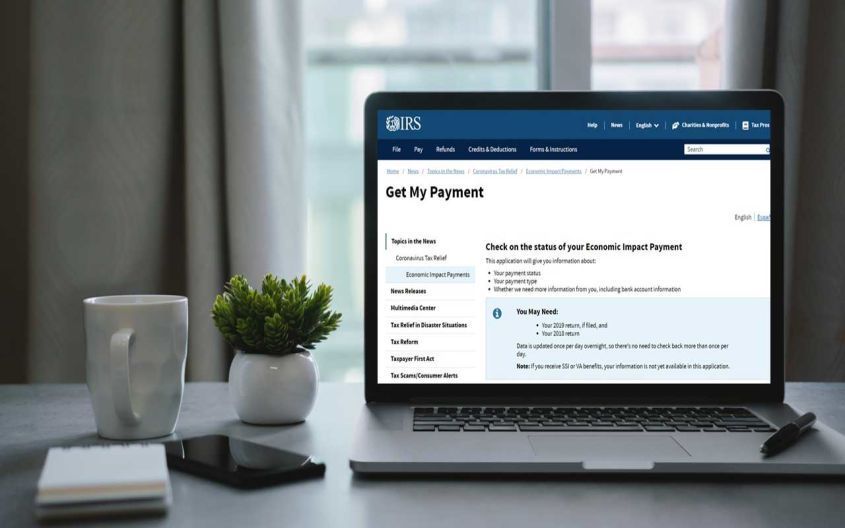

The IRS has already started sending out second stimulus checks. If you’re asking yourself “where’s my stimulus check,” the IRS will soon have an online tool that will let you track your payment. The tool is called the “Get My Payment” portal, and it will be an updated version of the popular tool Americans used to track the status of their first-round stimulus checks. (To find out how much money you will get, use our Second Stimulus Check Calculator.)

As of Sunday afternoon (January 3), the tool is still unavailable. But the IRS is working on updates for second-round stimulus checks and will have it back online soon. When the new version goes live, most people will be able to check the status of both their first- and second-round stimulus payments (if you received more than one first-round payment, the tool will show you only the most recent payment information). The tool will be available in both English and Spanish, too.

However, depending on your specific circumstances, you might not be able to access the portal. For example, expect your access to be denied if:

- You didn’t file a 2019 tax return;

- You didn’t use the “Non-Filers: Enter Payment Info Here” tool by November 21, 2020, to get a first-round stimulus payment; or

- You receive Social Security payments or other federal benefits, and the IRS doesn’t have enough information from the appropriate federal agency to process your payment.

- SEE MORE Second Stimulus Check Calculator

We expect the updated “Get My Payment” portal to more-or-less work the same as the tool used for first-round stimulus checks. So, here’s a refresher course on what the tool can do, what information you need to provide, and what information will the tool provide. Check it out so you’re ready to go when the tool goes live again.

What Does the Stimulus Check Portal Do?

Based on its past performance and new IRS information, we expect the updated “Get My Payment” tool to let you:

- Check the status of your stimulus payment;

- Confirm your payment type (paper check or direct deposit); and

- Get a projected direct deposit or paper check delivery date (or find out if a payment hasn’t been scheduled).

Unlike with the first-round stimulus checks, you won’t be able to enter your bank account information to have your payment directly deposited into your account. That’s because second-round stimulus payments are only being issued based on information the IRS already has on file ��� that is, bank information from:

- Your 2019 tax return;

- The IRS online registration tool for non-filers used for first-round stimulus checks;

- The “Get My Payment” portal if entered before December 22, 2020; or

- A federal agency that sends benefits to you (e.g., Social Security Administration, Veteran Affairs, or Railroad Retirement Board).

This bank information can’t be changed, either. Also note that, if you have federal benefits deposited to a Direct Express card, your second stimulus check may also be deposited to that card. The bank information shown in the “Get My Payment” portal will be a number associated with your Direct Express card and may be a number you don’t recognize.

You also won’t be able to request payment by debit card.

The earlier version of the portal was updated no more than once daily, typically overnight. That will probably be the case again. As a result, there’s no reason to check the portal more than once per day.

What Information Will You Need?

For starters, you’ll probably be asked to provide a:

- Social Security Number (SSN) or Individual Tax ID Number (ITIN);

- Date of birth;

- Street address; and

- Five-digit ZIP or postal code.

If you file a joint tax return, either spouse should be able to access the portal by providing their own information for the security questions used to verify a taxpayer’s identity. Once verified, the same payment status should be shown for both spouses.

If you submit information that doesn’t match the IRS’s records multiple times, you’ll be locked out of portal for 24 hours. Don’t contact the IRS if that happens. Instead, just wait 24 hours and try again.

For additional tips on entering data into the “Get My Payment” portal, see the IRS’ FAQ page (which we also expect to be updated).

What Will the Status Report Look Like?

For second-round stimulus checks, the “Get My Payment” portal will display one of the following:

1. Payment Status. A payment has been processed, a payment date is available, and payment will be issued either by direct deposit or mail.

2. Payment Status Not Available. If you receive this message, you were either not eligible, or eligible but the IRS was unable to issue you a second stimulus check. You will need to claim any additional amount you may be entitled to on your 2020 tax return as a “recovery rebate” tax credit.

If you get the “Payment Status Not Available” notice, this means the IRS can’t determine your eligibility for a payment at that time. There are several reasons this could happen. Two common reasons are that you didn’t file either a 2018 or 2019 tax return or your recently filed return has not been fully processed.Can You Use the Portal if You Didn’t File a Tax Return?

You couldn’t use the “Get My Payment” portal to track the status of your first stimulus check if you didn’t file a 2018 or 2019 federal income tax return. However, there was another online tool that non-filers could use to give the IRS with the information it needed to process a payment.

We don’t think the non-filers tool will be used for second stimulus checks, though. Instead, if you didn’t file a 2019 tax return, and you didn’t use the non-filers tool to get your first-round payment, then you’ll probably have to wait to get your second stimulus check money as a “recovery rebate” tax credit when you file your 2020 return.

My stimulus check went into my old account that was closed.I called the bank and they returned the deposit back to the IRS

on Jan,7,2021 I go into GET MY Payment still says the same in my closed account but not to worry read all the good updates that is a joke..Are they aware that we use computers now a days..Get some programmers into the IRS to help fix this..Per President Biden he will make sure this is corrected.How and when the rest of us want to know Could be Xmas 2021..

Respectfully

EMT