Louisiana’s current insurance reform supports big business and hurts families. Everyone agrees that Louisiana’s insurance crisis is complicated. Not enough insurers want to enter the market. Prices are sky high. Stories of people forced out of their homes are plentiful. Former Insurance Commissioner Jim Donelon worked to protect families. But the sands shifted. Tim Temple, the new Insurance commissioner, works to protect insurance companies.

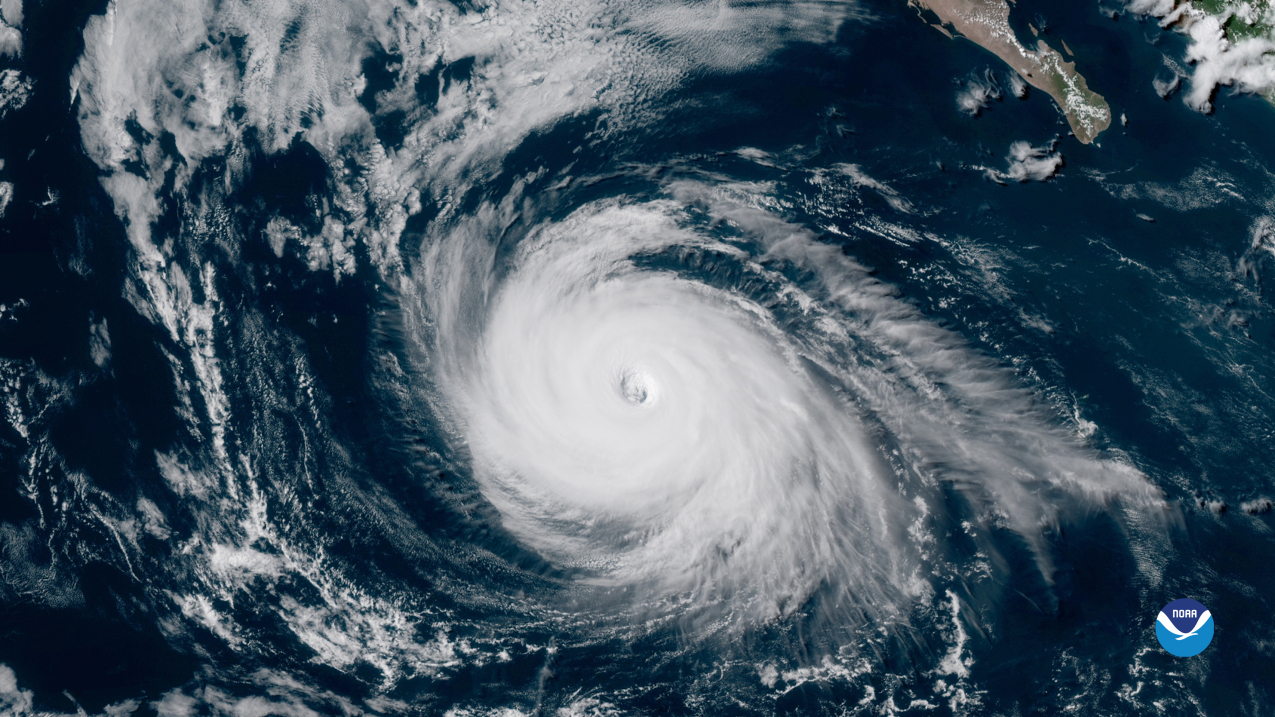

Climate changes are producing stronger and more frequent storms. Instead of protecting homeowners better, Temple’s agenda seeks to increase profits for insurance companies even in the face of more storms. Temple’s plan includes:

- Raising rates more often without any approval from an oversight agency

- Weakening or eliminating the three-year rule where companies can no longer drop policy holders.

- Allow big insurance companies to cherry-pick where they write policies

- Make it easier for insurers to delay and deny claims.

Three Year Rule Change

Bills like HB 611 are a direct attack on homeowners’ protections. Currently in Louisiana, insurance companies cannot drop a policy holder if they keep the policy for three years. During those three years, policy holders invested sometimes tens of thousands of dollars in premiums. Commissioner Temple favors companies just dropping the homeowner without explanation. In fact, Temple wants to let the company first raise the rates it charges to the same homeowner, then drop them.

Raise Rates

Another shameful bill proposed by a rural legislator is Senate Bill 295. This bill aims to let insurance companies raise rates without approval from any governing body. They simply send a notice to the policy holder of the upcoming rate increase and BAM, new rate. Smack dab in the middle of hurricane season. No storm predicted. Just cause the insurance company seeks a higher profit.

And don’t be fooled by the companies losing money narrative. Cause insurance companies still make billions annually. Especially the companies that operate in Louisiana. Even if you factor in more frequent storms. Companies raised their rates – more revenue. Higher interest rates bolster their bottom lines – and more revenue. And these companies received huge returns on their investments – even more revenue.

Lawsuit Reform

But the fun doesn’t stop there. Currently if you sue an insurance company and win, then your attorney’s fees are also paid by the insurance company. After they delayed, denied and depreciated your claim and you had no choice but to hire an attorney and file a lawsuit that you win, insurance companies want you to pay for your own attorney. And of course, Commissioner Temple supports this attack on homeowners.

Related: Legislators Debate Insurance Rates

Insurance reform is complicated. The system needs to work. But the current strategy only punishes homeowners and increases profits for insurance companies.

I liked Donalen He supported families. This guy is for business only