It’s election time. Early voting starts Every time there are amendments on the ballot, we break them down for you. This time there are eight amendments plus if you live in Orleans Parish a change to the home charter. Some are complicated, and a couple are controversial. Our constitution is old and big. Lets dig in and take a look at the constitutional amendments.

Amendment 1 (As it Appears on the Ballot)

CA No. 1 (ACT 130, 2021 – HB 154) – Modifies the maximum amount of monies in certain state funds that may be invested in equities

Do you support an amendment to increase to 65% the cap on the amount of monies in certain state funds that may be invested in stocks? (Amends Article VII, Sections 10.1(B), 10.8(B), 10.11(D), and 14(B))

| Trust Fund Balances as of June 30 |

| Louisiana Education Quality Trust Fund: $1,524,966,040 |

| Millennium Trust: $1,531,553,859 |

| Artificial Reef Development Fund: $18,734,438 |

| Lifetime License Endowment Trust Fund: $25,139,342 |

| Rockefeller Wildlife Refuge Trust and Protection Fund: $76,481,668 |

| Russell Sage or Marsh Island Refuge Fund: $19,264,477 |

| Medicaid Trust Fund for the Elderly: $17,910,96 |

The table above shows the trust funds that Louisiana has. Currently the State Treasurer is limited on how much can be invested in the stock market. Some funds are limited to 35% others bar any investment in the stock market.

A yes vote and why – allows the state to invest up to 65% in the funds that can be invested in the stock market. Proponents say limiting the amount of money invested limits the amount of money these funds have to provide to education and healthcare and all the important things they do.

A No vote and Why – Investing in the stock market has short term risks that could reduce the amount of money available to provide to these same trusts.

Amendment 2

CA No. 2 (ACT 172, 2022 – HB 599) – Expands property tax exemptions for homestead exemption property for veterans with disabilities

Do you support an amendment to expand certain property tax exemptions for property on which the homestead exemption is claimed for certain veterans with disabilities? (Amends Article VII, Section 21(K))

Louisiana has a $75,000 homestead exemption for properties that residents live in. Currently parishes can give 100% disabled veterans and/or their spouses another $75K. This amendment provides more money for less disabled veterans. The amendment creates a sliding scale that you see in the table below.

| Service-Connected Disabilities and Property Tax Exemptions |

| Level of Disability Current Exemptions (with local approval) |

| 100% Service-Connected Disability Up to $150,000 |

| 100% Unemployability Up to $150,000 |

| Level of Disability Proposed Exemptions (all parishes) |

| 100% Service-Connected Disability Total Exemption |

| 100% Unemployability Total Exemption |

| 70% to 99% Service-Connected Disability Up to $120,000 |

| 50% to 69% Service-Connected Disability Up to $100,00 |

Related: Our Look at the 2021 Amendments

A Yes Vote and Why These veterans and their families sacrificed for our country and can’t work because of it. They deserve our continued support

A No Vote and Why We already have too many exemptions and this decreased revenue puts a strain on local governments.

Amendment 3

CA No. 3 (ACT 156, 2021 – HB 315) – Allows classified civil service employees to support election of family members to public office

Do you support an amendment to allow classified civil service employees to support the election to public office of members of their own families? (Amends Article X, Sections 9 and 20)

Louisiana law prohibits members of a state or local civil service commission and state and local government employees – classified workers – from participating in political activities. They cannot work on campaigns or for a political party, attend fundraising events for a candidate or make or solicit contributions. They are allowed some participation in photos and fundraising events if a spouse is running for office.

A Yes Vote and Why – People should be allowed to publicly support their family members campaigns. They still have the freedom of speech

A Vote No and Why – Taxpayers should no pay the salaries for campaign workers. And classified workers and civil servants should be protected against political retaliation.

Amendment 4

CA No. 4 (ACT 155, 2021 – HB 59) – Authorizes a political subdivision to waive charges for water under certain circumstances

Do you support an amendment to allow local governments to waive water charges that are the result of damage to the water system not caused by the customer? (Amends Article VII, Section 14(B))

The Sewerage and Water Board has been breaking this law for decades. If you complain about your bill being to high and they come out and investigate and find the break is on the city side of the system they reduce your bill. This is illegal in Louisiana because e the government cannot give anything of value to citizens. Even if the break is on the city side. Once that bill goes into effect then there can be no bill reduction. This amendment attempts to fix that.

A Yes Vote and Why. Water companies should be able credit customer’s bills if the error is not the customer’s fault.

A No Vote and Why Water utilities are struggling across the state and changing customer’s bills opens them up to political pressure.

Amendment 5

CA No. 5 (ACT 133, 2021 – SB 154) – Provides relative to property tax millage rate adjustments and maximum authorized millage rates

Do you support an amendment to allow the levying of a lower millage rate by a local taxing authority while maintaining the authority’s ability to adjust to the current authorized millage rate? (Amend Article VII, Section 23(C))

Every four years, Louisiana reassesses property values. Even if property values rise, government agencies that receive millage money must keep the taxes they collect the same in those years. If property values rise and the tax revenue increases, agencies must rollback their millage rates to keep the taxes the same. This amendment allows the agencies to roll forward as needed in the future to collect the full millage amount.

A Yes Vote and Why – Taxing agencies need the time to properly budget. Currently they automatically roll forward to the highest rate. So homeowners pay higher rates, because agencies don’t want to have budget shortfalls.

A No Vote and Why – Keeps things the same because the agencies currently have enough time to figure out if they need the full amount of the available millage

Amendment 6

CA No. 6 (ACT 129, 2021 – HB 143) – Limits the increase in assessed value of certain property following reappraisal in Orleans Parish

Do you support an amendment to limit the amount of an increase in the assessed value of residential property subject to the homestead exemption in Orleans Parish following reappraisal at ten percent of the property’s assessed value in the previous year? (January 1, 2023) (Amends Article VII, Section 18(F)(2)(a)(introductory paragraph) and Adds Article VII, Section 18(F)(3))

New Orleans is seeing wild increases in property values. Some property values increased over 300%. The resulting property taxes are shocking and sometimes unaffordable for longtime property owners. This amendment applies only to Orleans Parish. It limits the tax bill increase to only 10% for the first year of the new appraised value.

A Vote Yes and Why – People who have lived in a neighborhood for generations can no longer afford the property taxes because of gentrification. The 10% cap helps families manage the higher tax bill and keep the family home. The full tax bill is just phased in over time.

A No Vote and Why – The reduced revenue is not good in New Orleans. The city is struggling now to keep up with service costs.

Amendment 7

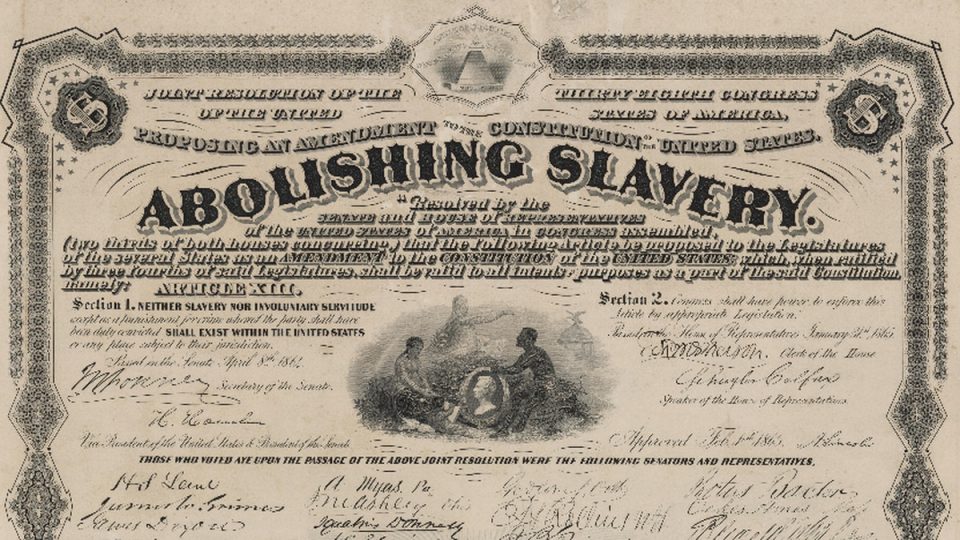

CA No. 7 (ACT 246, 2022 – HB 298) – Provides relative to the prohibition of involuntary servitude and administration of criminal justice

Do you support an amendment to prohibit the use of involuntary servitude except as it applies to the otherwise lawful administration of criminal justice? (Amends Article I, Section 3)

States around the country are trying to get rid of the slavery language from their constitutions. In Louisiana’s attempt, the original sponsor of the bill pulled his support because he said the language got twisted. The amendment revises the constitutional language allowing slavery and involuntary servitude in Louisiana. It currently says involuntary servitude can be used as a punishment for crime. The change only allows slavery and involuntary servitude for the “otherwise lawful administration of criminal justice.”

A Vote Yes reworks the constitutional ban on slavery except as punishment for crime to say the otherwise administration of criminal justice.

A No Vote Keeps the state’s current constitutional language banning slavery and involuntary servitude, but allowing involuntary servitude as a “punishment for crime.”

Amendment 8

CA No. 8 (ACT 171, 2022 – HB 395) – Removes requirement of annual certification of income for certain eligible disabled homeowners

Do you support an amendment to remove the requirement that homeowners who are permanently totally disabled must annually re-certify their income to keep their special assessment level on their residences for property tax purposes? (Amends Article VII, Section 18(G)(1)(a)(iv))

Currently people who are totally and permanently disabled have to recertify every year that the are still the same. This amendment removes that requirement

A Yes Vote and Why – Would remove the burden on totally and permanently disabled people. Their assessment freeze would remain in place until they and their spouse die.

A No Vote requires totally and permanently disabled people to certify annually that they are in fact totally and permanently disabled.