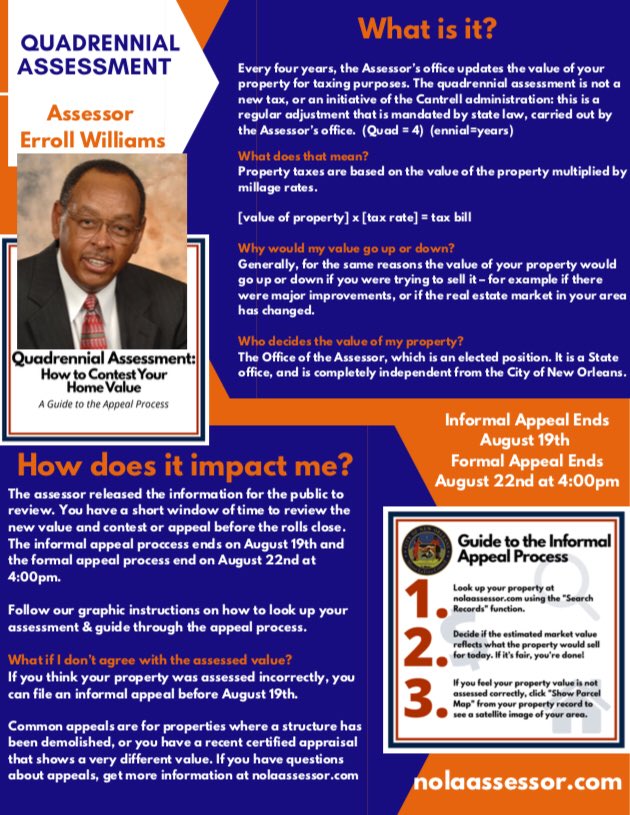

Almost everybody’s property taxes in New Orleans have gone up. And risen significantly in most cases. Some have even doubled. Gentrification, state laws and a host of other factors contribute to the increases. Whatever the reason, New Orleanians should one man for their high property tax bills – tax assessor Erroll Williams.

But property values and their taxes usually rise over time. And even though this cycle seems more steep than normal, Assessor Williams is like Teflon. The higher taxes do not stick to him personally. People must believe that he has no control over the taxes they are billed.

Erroll Williams

Williams’ don’t blame the messenger narrative has worked for over 35 years. Despite the highest taxes in the history of New Orleans, Williams qualified to run again. And he is favored to be reelected for the 10th time in his storied political career. Back in 2011 votes elected Williams as the first citywide assessor. He is still the only citywide assessor in New Orleans’ history. Williams is seen as a hard-working old school leader. He gets in the office early and leaves late. He often speaks at senior citizens events. In fact Williams has been instrumental in getting New Orleanians over 65 to have their assessments frozen.

Williams is a part of the LIFE political organization. LIFE dominated 7th, 8th and 9th ward politics. The old adage was if you could win 789 then the city was yours. Dutch Morial, Marc Morial, Marlin Gusman, Cynthia Willard Lewis and Errol Williams transformed 7th ward dominance into a stranglehold on citywide politics. Gusman and Williams still rep the LIFE political flag.

Carlos Hornbrook

This election Williams has serious competition from Carlos Hornbrook. He is an attorney who wants “to bring New Orleans back!” Mr. Hornbrook sees the assessor’s office as critical part of the economy. He says the assessor overvalues properties. This creates unusually high tax bills and rakes money out of the economy that could be used to fund police, fire and EMS. Also, the higher taxes create challenges to home ownership.

Mr Hornbook is on a mission. “It is my mission to be fair with both individual homeowners and commercial property owners when it comes to their property assessment and to develop small business ownership specifically within the New Orleans East, 9th Ward and Central City areas.”

Mr. Hornbrook says that 90% of property owners who contest their property values get a reduction in their property taxes. “And this is just evidence that properties are not being accurately assessed in New Orleans!”

Gregory Lirette

Interestingly enough, Mr. Lirette’s website for assessor is linked to a previous campaign for Congress.

Mr. Lirette was disqualified from the race!!

Andrew Gressett

One can only surmise that his campaign is about lowering taxes as his formal campaign name is Andrew (Low Tax) Gressett. But Mr. Gressett is a real estate professional and has a serious campaign. His 3 top reasons for entering the race-

- Office has transformed from an assessment office to a tax collection office. This and gentrification makes New Orleans too expensive for New Orlenians.

- Implement a 12-year term limit on the office

- Reassess all properties to make allowance for quality-of-life issues in neighborhoods. People should not be paying for services they do not receive.

When asked his biggest reason for entering the race, Mr. Gressett said, “Mr. Williams is stubbornly ignoring the effects of gentrification on property values. This leads to unfairly high assessments and is destabilizing our city.”

Anthony Brown

Mr Brown is a single-issue candidate. He believes that homeowners have been forced out of their homes by “overtaxing”. Mr. Brown promises to use the Louisiana constitution to reduce taxes and ensure that all citizens have access to housing.

All of the candidates cite gentrification as the primary reason property taxes have risen so significantly this time. All homeowners feel the increase in prices. Can Errol Williams message of I’m just the messenger and do not control market forces carry him into 40 years in office? Keep in mind, Errol Williams is another undefeated politician.

RELATED: EVERY CANDIDATE IN EVERY RACE

My property taxes are to damn high!! Errol is the problem. vote for anybody but him

My taxes were changed by the assesor after I asked him and showed him proof!!

It’s Time For a New Messenger and a New Message,

If Errol Williams is the messenger then why is it that only one property tax was lowered in his old Gentilly Woods neighborhood? Is it a coincidence that the one property tax lowered in his old Gentilly Woods neighborhood was the property owned by Errol Williams? Was Errol Williams the messenger who delivered the information that he only lowered his own property tax? So what’s the message? Is the message, “If you’re the assessor, it’s OK to lower your own property taxes.” Is the message, “Don’t worry about regular citizens.” During this past year of the pandemic, the property owners in the CBD made the argument that their property tax should be lowered because business was bad during the pandemic. Could individual property owners make the same argument? Does Errol Williams even listen to regular citizens? He certainly seems to listen to the business establishment. It was huge mistake voting to elect one New Orleans assessor.

Great article! I’d like to point out one important part of the property tax bill calculation that has to be mentioned: millage/tax rates. Taxing authorities such as the City of New Orleans, school board, levee board, SWB etc. have the authority to set tax rates that will offset any increases in property values proposed by the assessor’s office and approved by the city council through the Board of Review and the Louisiana Tax Commission. However, they rarely choose to lower millage/tax rates, resulting in windfalls to those taxing authorities who will argue that the increases are necessary to run their organizations effectively. Yet, the public pressure of higher property tax bills seems to fall solely on the assessor’s shoulders. Taxpayers rarely appear at public meetings of the taxing authorities to exert pressure to lower millage/tax rates. P.S. For full disclosure, these observations are from a biased view as I am an employee of the assessor’s office