The Louisiana insurance market is in bad shape. Fewer companies give homeowners limited options. In the past, Louisiana was a fertile market. Not too many hurricanes hit the state. And the ones that did were not that strong in the last 100 years. Louisiana was such a great market that the companies were clamoring to enter the market. In fact, former state Commissioner Sherman Bernard extorted several insurance companies that wanted to sell insurance in the state. Bernard went to jail for squeezing $80,000 from companies that wanted to sell insurance in Louisiana.

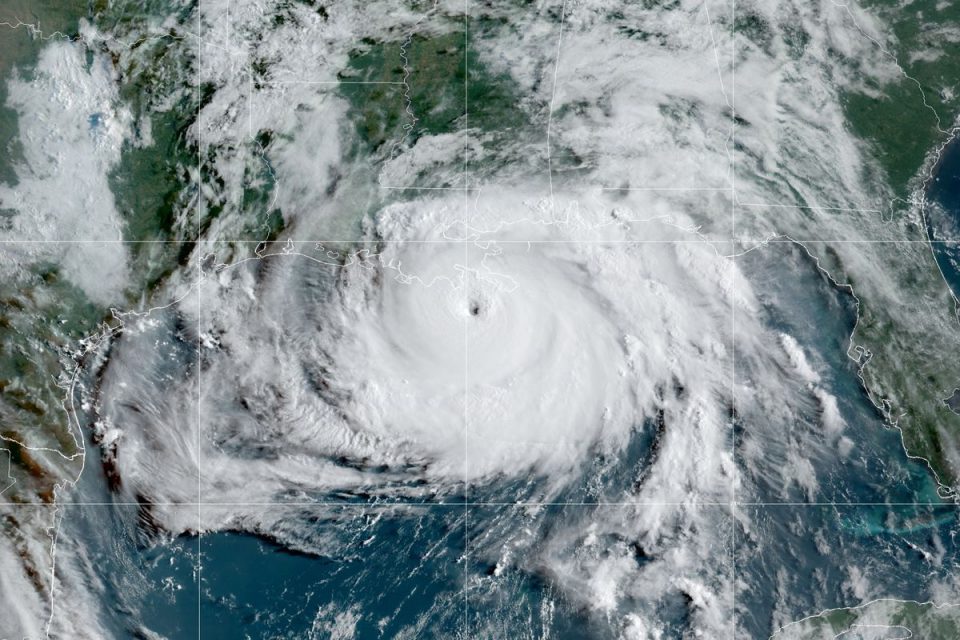

In fact, not until Jim Donelon assumed office did state insurance commissioners get back to the business of regulation. But the market dynamics shifted dramatically during Donelon’s tenure. Donelon assumed the role after Hurricane Katrina decimated New Orleans and the surrounding areas. The biggest disaster at the time started the mass exodus of insurance carriers from the market. Then more frequent and more powerful storms started hitting the state. In a short 15 years, claims exceeded $30 billion dollars. Some insurers stopped writing new policies in hurricane prone areas and others just left the state entirely.

Market Dynamics Shifted

But Jim Donelon was an old school insurance commissioner. He saw his role as protector of the people. He required insurance companies to pay claims on time and fully. If they didn’t, he fined them. Donelon insisted that all rate increases had to be approved by his office. And he created and pushed through the legislature a rule that insurance companies must continue to insure a policy holder if they had the policy for at least 3 years. No dropping. But while Donelon chugged along with 20th century consumer protection policies, storms blasted Louisiana with 21st century climate change debate frequency.

The primary reason states regulate insurance companies is to promote and maintain competition. Competition in the insurance industry insures competitive rates and it leads to the reduction in risk and uncertainty, enables efficient resources allocation, enhances product innovation, enhances economic growth and improves efficient production of financial services.

Unfortunately, Louisiana’s insurance market quickly began to unravel. So, Donelon needed to be creative. And in an ironic twist, instead of companies bribing the insurance commissioner to get into the state, the insurance commissioner started bribing insurance companies to write policies in Louisiana. Donelon actually proposed and secured grants to insurance companies. The state gave away over $50 million dollars to incentivize companies to do business in the state. But Donelon seemed confused with the new marketplace and without any other ideas. And after 18 years protecting the citizens of the state, Donelon retired. When Donelon entered office, over 250 companies wrote policies in Louisiana. When he left, fewer than 40 wrote policies in hurricane prone areas.

What Are the Options

Change is necessary. New Commissioner Tim Temple immediately changed the focus and thrust of the office. Recognizing the state could not continue to just give away money to incentivize insurance companies, Temple made the market business friendly. Some say too business friendly. He immediately changed all the rules and requirements of the Donelon tenure. He killed the three year no drop policy. In fact, under Temple’s plan, insurance companies can drop you whenever they want. The rule about rate increases being approved by the commissioner is also revoked. And Donelon limited companies to one rate increase per year. Under Temple, companies can increase rates as often as they want to in a year. They simply need to inform the insurance commissioner they are raising rates. Also, Donelon limited the amount a company could increase. Under Temple, there companies are able to raise rates as high as they want.

Related: How Insurance Reforms Attack Homeowners

Keep in mind these changes are supposed to reduce rates in the long run. The logic is that more profits mean more competition which eventually means cheaper rates.

With little options, homeowners have no choice in the matter. The legislature approved all these changes. Gov Landry signed them into law. The insurance market in Louisiana below the I-10 is still in chaos. The only way to bring stability to the market is to have another run of no hurricanes hitting the state. Then insurance companies can make a profit and build reserves to pay future claims. However, this year is predicted to be one of the most active hurricane seasons on record. Expect your rates to rise. You might get dropped. Finding a new company is extremely difficult. But, the most troubling thing is that there is no evidence that any of this will reduce any rates for any homeowner

At least you can carry your gun under your coat if you come back to see what the damage is to your property.

Seems to be changes financed by the insurance industry to the detriment of the customer. The voters chose these people so let’s see what it costs them.

Our esteemed ex insurqance executive and current insurance commisionerdoesn’t see what good it would be to fine insurance companies that defraud, deduct and/or delay payments to insureres. How about deterrence?

He claims his critics dont propose solutions. Did he not see the success Alabama is having when they included mandatory premium reditions of 20% when the insured implemints roof hardening with state tax credits? Did he not read the Times Picayunne’s article on how 11 out of the 12 companies went under were “affiliate” companies that are essemtially dark pools that drain premiums to investors and executives. Reform of that and the mandatory reduction in premiums were opposed by Mr. Temple.

Fair minded insurance companies that pay their claims timely rarely if ever had to pay penalties under our bad faith laws that existed until Mr Temple took his knife to them.

These are just a few of the ways he has watered them down to almost nothing. The amended bad faith laws that he enected did the following damage. It:

1. takes away the damages we had of twice the amount (200%) under previous Statute 22:1973 and reduced it to 50%. (I was in error when I said it went from 100% to 10%). So it was already limited and now its is cut by 75% on top of that. And remember this requitres bad faith which requires a proof of “arbitrary, capricious, or without probable cause”. That is a difficult thing to show. Any reasonable defense, even if it is rejected by a judge or jury, can be a defense to the bad faith penalty. Fair Insurance cos dont need to worry about bad faith laws.

2. reduces attorney fees from “reasonable” which can be as much as 40% if the judge feels they were reasonable under the circumstance to 20%. That is essentially a 50% reduction.

3. It doubles the delay from 30 days to 60 days.

4. Not only does it double the delay and cut the penalties from 200% to 50%, it requires a new proof of economic loss. So its not a penalty at. all it is, is fair compensation and limited compensation at that. This is no “penalty” or punishment which is what it should be. Other than say the insterest which is due anyway how do you prove “economic damages”?

5. another speed bump on the road to justice is the 60 day “cure periond” whihc further delays payment and excuses any bad faith penalites. In fact not only does it further delay the running of the delay time, it punishes the insured by making them eat the court costs which is always paid by the party who loses , I.E. the insurance company that finallly pays what it owed in the first place. And amazingly, another 60 days (90 days for catistrphic loss). “f the alleged violation is not “cured” within the 60-day notice period and suit is filed, §22:1892.2 adopts the penalties available and standards (e.g., satisfactory proof of loss) set forth in the current §22:1892 but extends the time delays to” ANOTHER 60 or 90 days. What do you think would happen if you were 120 days late in paying your premium?

These speed bumps on the road to justice as I call them are unfair to his constituents. People in Lake Charles are still living with open studs and blue tarps on their homes 3 years after the damage was sustained. Some have gone bankrupt waiting. Commissioner Teeple said yesterday they dont deserve fines. He is not fining a single one fo them yet La has the worst record of delays for insurance payments in the nation.

Cordially,

Bob Manard