The City Council Looked Away

New Orleans may be days from losing control of its finances. The council has called in the Legislative Auditor, the mayor requested a $125 million short-term loan to cover payroll, and Governor Jeff Landry has publicly warned of the city’s financial collapse.

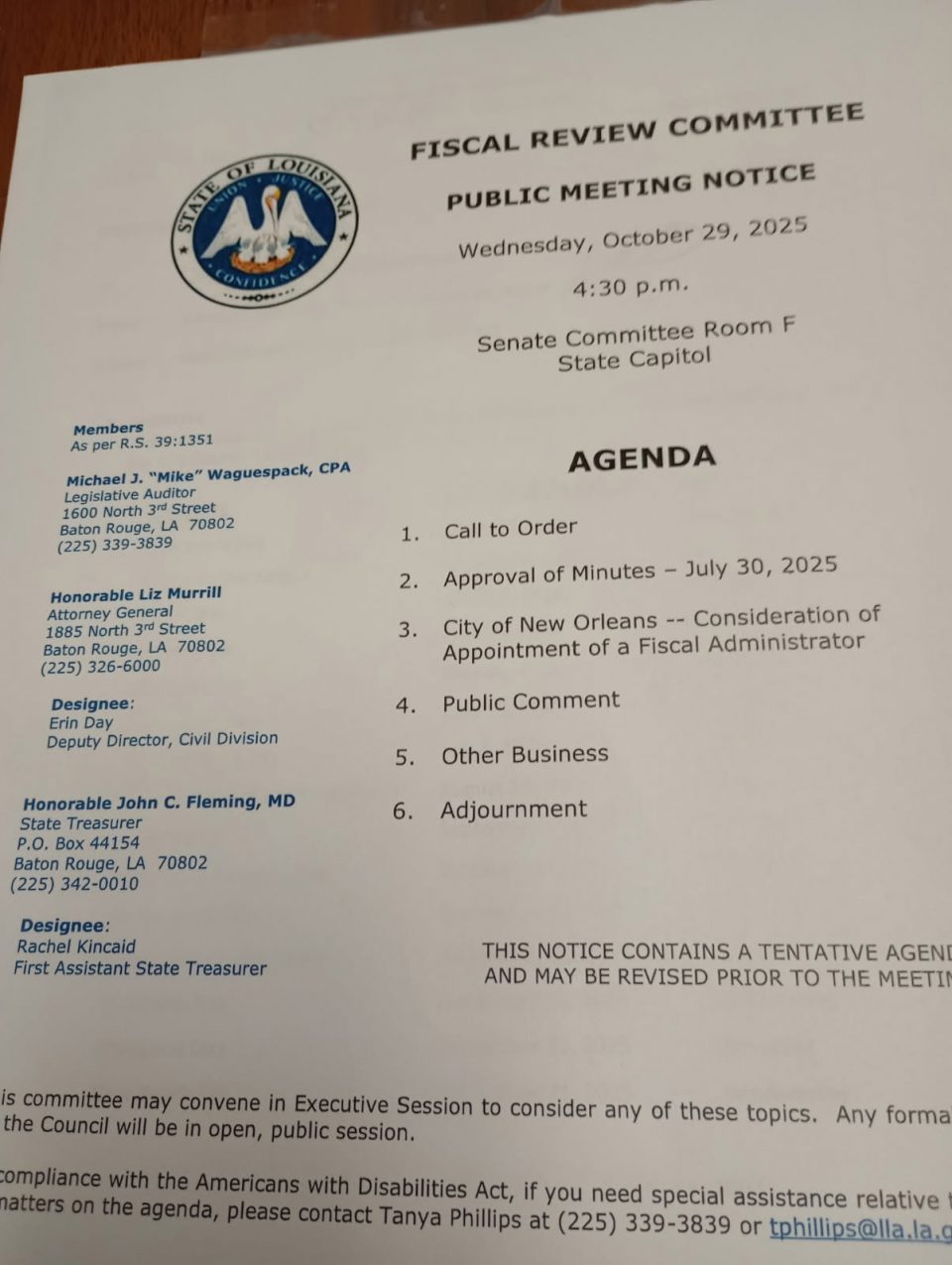

Now he’s convened the State Fiscal Review Committee —the same body that triggered Bogalusa’s takeover—to consider appointing a Fiscal Administrator for New Orleans.

That move would strip the incoming administration of its budget power. The irony? It’s the same council whose obsession with political spectacle opened this door.

Ignored Warnings

Councilman Oliver Thomas urged disciplined budget oversight months ago. He called for transparency and mid-year corrections. His colleagues didn’t follow his lead.

Instead, JP Morrell and Helena Moreno fixated on the Pontalba apartment controversy, dissecting every rumor about the mayor’s alleged relationship with a security officer. For weeks, television and print outlets looped footage and interviews. While they chased gossip, the city’s books deteriorated.

The council grilled the mayor about travel but ignored growing deficits. That neglect—political vanity posing as accountability—now threatens to cost them the very authority they fought to expand.

The Law: When the State Steps In

Louisiana Revised Statutes 39:1351 – 1357 spell out fiscal intervention.

If the Legislative Auditor, Attorney General, and State Treasurer unanimously decide a city cannot meet payroll or debt, the Attorney General must petition the court.

A judge then appoints a Fiscal Administrator—a state-backed receiver who controls spending, contracts, and budgets.

The city must pay for that administrator plus all related oversight costs. Guess what? They meet tomorrow!

Home-Rule protections under Article VI of the Louisiana Constitution do not stop this. Local autonomy ends where insolvency begins. That is how Bogalusa lost control of its finances, and the same path now lies open for New Orleans.

How We Got Here

The City Charter gives the council one central duty: adopt and monitor a balanced budget.

Yet the 2024-25 plan passed with shaky revenue assumptions and little analysis.

When cash dried up, the administration sought a public, short-term $125 million bridge loan to meet payroll, while the council requested a Legislative Auditor review. Those steps triggered state scrutiny and the Fiscal Review Committee’s involvement.

Related: Montano Left the City a Hot Mess

Once that committee meets, the governor’s team can move fast.

If it declares a probable default, the Attorney General files in district court and a Fiscal Administrator steps in.

That official can freeze hiring, halt projects, and override local spending—all with judicial backing.

Consequences for the Incoming Administration

A fiscal takeover means:

- Budgets rewritten. Campaign promises yield to state-mandated austerity.

- Council sidelined. Fiscal decisions route through the administrator.

- Political humiliation. Leaders who sought more control will lose it entirely.

- Public distrust. Citizens will see Baton Rouge running City Hall.

The cost to civic pride would be immense. The city that rebuilt itself after Katrina could again be branded financially incompetent.

A Preventable Failure

This isn’t bad luck—it’s mismanagement.

While the council obsessed over the mayor’s personal life, it ignored its core responsibility: guarding the city’s budget.

When Councilman Thomas pushed for fiscal discipline, colleagues brushed him aside.

Now the same members who schemed to weaken the mayor’s office may watch both branches lose power to a state appointee.

That’s not merely embarrassing—it’s a disgraceful collapse of governance.

What Citizens Must Demand Now

- Financial Transparency. Publish daily cash and payroll reports.

- A Real Recovery Plan. Cut non-essential spending, protect core services.

- Independent Verification. Keep the Legislative Auditor engaged until the books balance.

- Political Accountability. Demand answers from council leaders who traded responsibility for headlines.

The Bottom Line

If New Orleans cannot meet payroll or debt within sixty days, the state can—and likely will—seize financial control.

The council that obsessed over rumors instead of revenue will watch Baton Rouge run its budget.

The word “disgusting” understates it.

It is a betrayal of public trust.

New Orleans fiscal crisis; Jeff Landry Fiscal Review Committee; City Council budget oversight; Oliver Thomas budget warning; state takeover New Orleans; Bogalusa Fiscal Administrator; Louisiana Legislative Auditor; New Orleans financial collapse.

And now she is mayor 🙂 😀 😃 🙂 Silly only in New Orleans